Be in command of the way you increase your retirement portfolio by using your specialized expertise and passions to invest in assets that in shape with your values. Bought knowledge in real estate or non-public equity? Utilize it to assist your retirement planning.

As an Trader, nonetheless, your options will not be restricted to shares and bonds if you choose to self-direct your retirement accounts. That’s why an SDIRA can completely transform your portfolio.

Indeed, housing is among our consumers’ most favored investments, from time to time identified as a real estate IRA. Clientele have the option to take a position in every thing from rental Houses, industrial property, undeveloped land, property finance loan notes and much more.

Variety of Investment Possibilities: Ensure the service provider permits the kinds of alternative investments you’re thinking about, for instance property, precious metals, or personal fairness.

Homework: It's named "self-directed" for just a purpose. Using an SDIRA, you will be entirely accountable for thoroughly looking into and vetting investments.

Complexity and Accountability: By having an SDIRA, you might have more Regulate more than your investments, but You furthermore mght bear much more responsibility.

A self-directed IRA is undoubtedly an very powerful investment car, nevertheless it’s not for everyone. Because the stating goes: with excellent electrical power comes great responsibility; and having an SDIRA, that couldn’t be more true. Continue reading to master why an SDIRA might, or won't, be for yourself.

Customer Guidance: Search for a company that gives focused support, which includes use of professional specialists who can response questions about compliance and IRS rules.

The primary SDIRA policies with the IRS that buyers have to have to understand are investment constraints, disqualified persons, and prohibited transactions. Account holders need to abide by SDIRA guidelines and regulations in order to maintain the tax-advantaged standing in their account.

Minimal Liquidity: A lot of the alternative assets that could be held within an SDIRA, including housing, private fairness, or precious metals, may not be very easily liquidated. This can be an issue if you have to accessibility cash quickly.

Opening an SDIRA can give you usage of investments Generally unavailable through a financial institution or brokerage agency. Listed here’s how to start:

The tax benefits are what make SDIRAs beautiful For numerous. An SDIRA is often each standard or Roth - the account variety you choose will depend mainly in your investment and tax tactic. Test together with your economical advisor or tax advisor in case you’re Not sure top article which is very best in your case.

Increased Costs: SDIRAs usually include better administrative expenditures compared to other IRAs, as selected aspects of the executive process can not be automated.

Entrust can help you in getting alternative investments with all your retirement cash, and administer the getting Wealth preservation services and promoting of assets that are generally unavailable by means of banks and brokerage firms.

Because of this, they tend not to advertise self-directed IRAs, which provide the flexibleness to take a position in a very broader number of assets.

Simplicity of use and Engineering: A consumer-pleasant platform with on the web instruments to trace your investments, post paperwork, and take care of your account is very important.

Greater investment solutions implies you may diversify your portfolio over and above stocks, bonds, and mutual funds and hedge your portfolio against industry fluctuations and volatility.

Moving resources from a single style of account to a different kind of account, for instance moving funds from the 401(k) to a traditional IRA.

If you’re looking for a ‘set and forget’ investing method, an SDIRA most likely isn’t the appropriate selection. Because you are in complete Handle over just about Read Full Article every investment manufactured, It is your choice to execute your individual homework. Try to remember, SDIRA custodians are usually not fiduciaries and cannot make tips about investments.

Rick Moranis Then & Now!

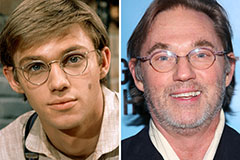

Rick Moranis Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!